utah state solar tax credit 2020

In 2020 the maximum tax credit was. From 2018 to 2021 the.

Dominion Offloads Stake In California Utah Solar

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system.

. We are accepting applications for the tax credit programs listed below. If you are starting a solar system project in 2021 but the completion date is 2022 the credit will be 22. Summary of Utah Low-Income Housing Tax Credit.

The process to claim the Utah renewable energy tax credit is relatively simple and. The Utah residential solar tax credit is also phasing down. This rate is gradually decreasing.

See all our Solar Incentives by State All of Utah can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation. The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less. There is no tax credit on solar panels that you.

Utah has a state tax credit for solar. A Secure Online Service from Utahgov. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is.

The cap dollar amount you can receive begins to phase down as follows. Utahs solar tax credit currently is frozen at 1600 but it wont be for long. Renewable energy systems tax credit If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar.

They vary in amount but are usually a percentage of the total cost of the. Utah Governor Gary Herbert signed a new bill into law SB 141 that grants an extension to the states solar tax credit. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply.

In 2022 the Utah residential solar tax credit stands at 25 percent of the eligible system cost or 800 whichever is less. Current federal and Utah solar tax credits offer an incentive to invest now. 25 capped at 1200 until 123121 25.

Log in or click. Attach TC-40A to your Utah return. By Tracy Fosterling on Mar 28 2018.

Renewable Energy Systems Tax Credit Application Fee. Utah Office of Energy Development - Energy Tax Credits Welcome to the Utah energy tax credit portal. 2000 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit.

Utah Code 59-10-1014 This credit is for reasonable costs including installation of a residential energy system that supplies energy to a Utah residential unit. Offer helpful instructions and related details about Utah Solar Tax Credit 2020 - make it easier for users to find business information than ever. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the.

The bill extends the cap on the. In 2022 the Utah residential solar tax credit stands at 25 percent of the eligible system cost or 800 whichever is less. Under the Amount column write in 2000 a.

The RESTC program offers a tax credit of 25 of the eligible cost of the. Application fee for RESTC. The Utah tax credit for solar panels is 20 of the initial purchase price.

State Low-income Housing Tax. Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Utahgov Checkout Product Detail.

Top Solar Companies In Pa Top. This is 26 off the entire cost of the system including. Until December 21 2020 this tax credit covers the lesser of 25 percent or 1600 of any residential solar panel array.

You can receive a maximum of 1000 credit for your purchase. This rate is gradually decreasing. All state solar tax credits can be claimed in addition to the federal governments investment tax credit.

Both of these tax credits will decrease over the next few years and end in 2025.

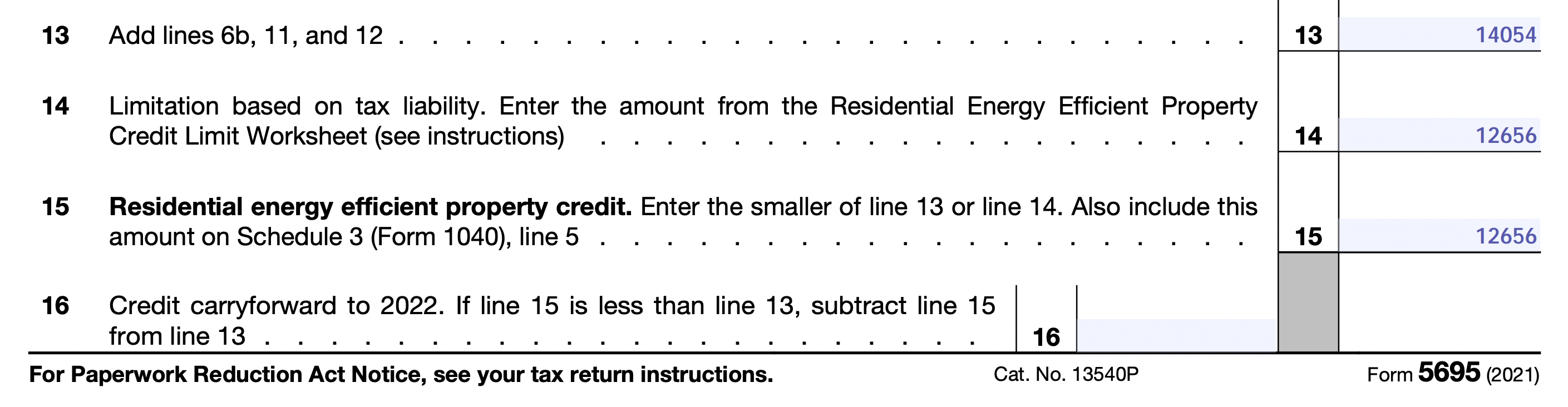

How To Claim The Solar Panel Tax Credit Itc

How To Claim The Solar Panel Tax Credit Itc

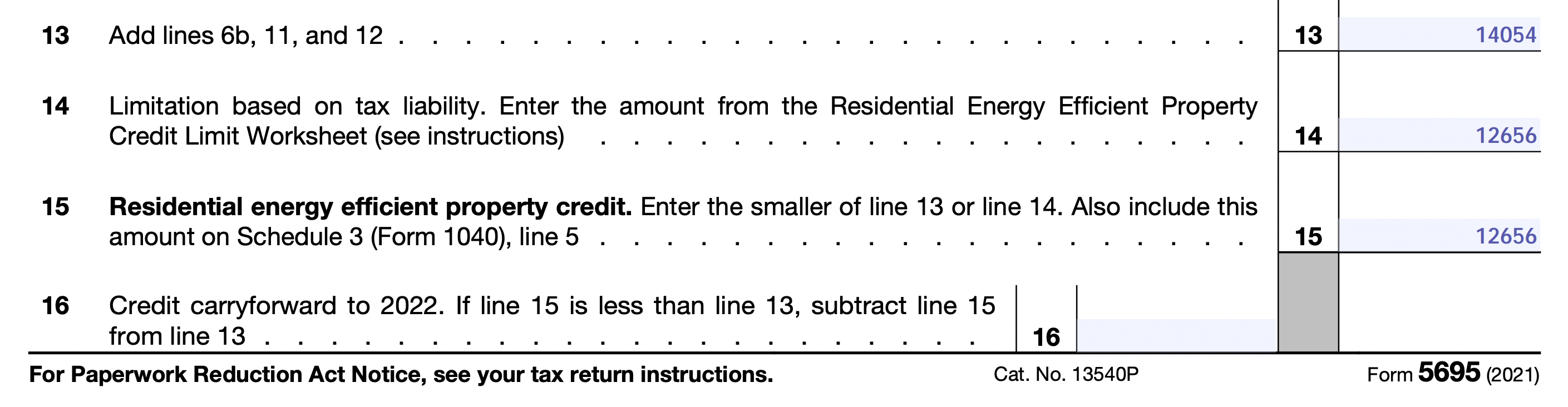

Clean Technol Free Full Text Environmental Comparison Of Different Mechanical Ndash Biological Treatment Plants By Combining Life Cycle Assessment And Material Flow Analysis Html

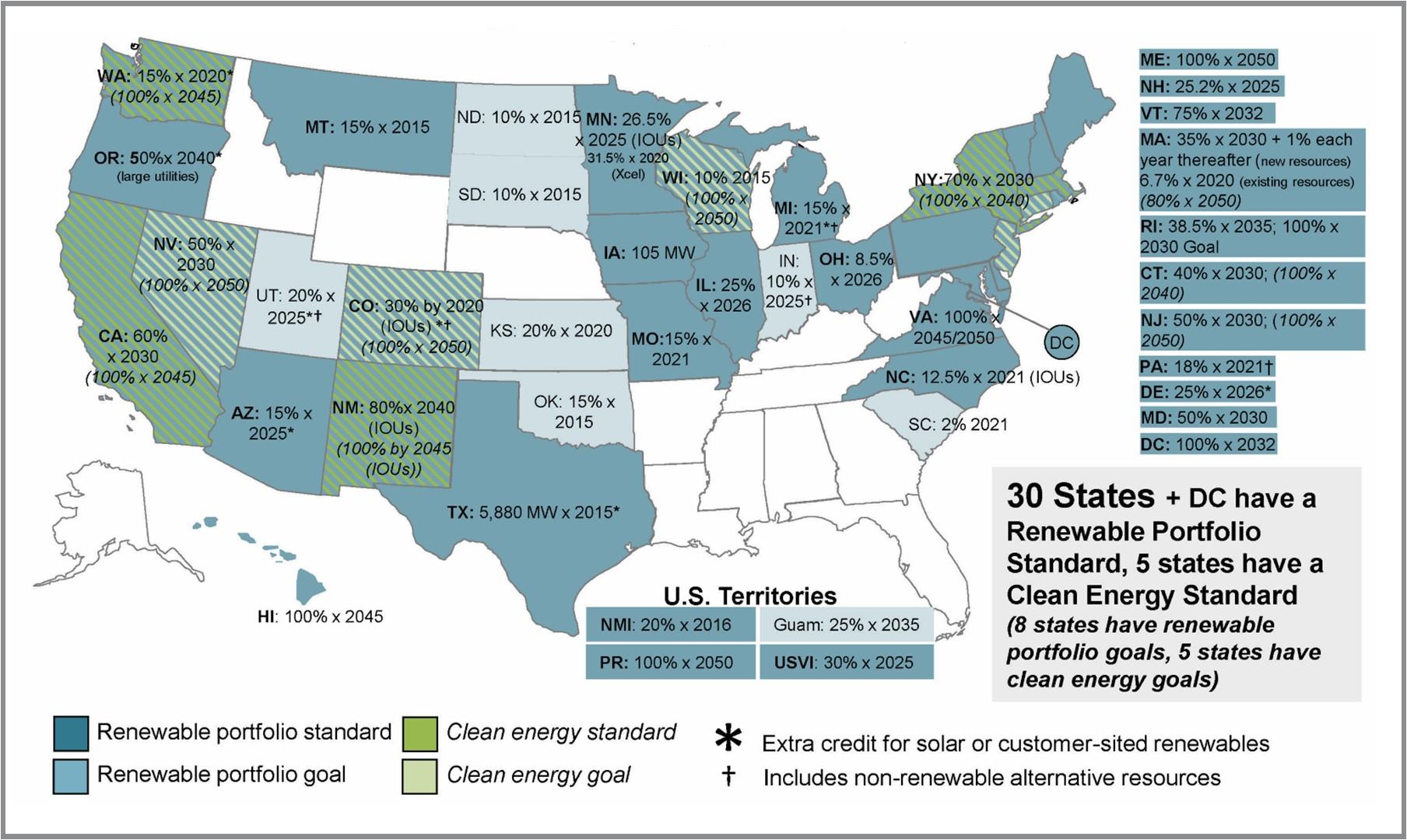

The Federal Solar Tax Credit Has Been Extended Through 2023 Ecohouse Solar Llc

Solar Investment Tax Credit Itc At 26 Extended For Two Years Creative Energies Solar

Utah S Rooftop Solar Market On The Skids With Net Metering Change Pv Magazine Usa

Solar Panels Are An Increasingly Common Sight On Urban And Rural Properties Across Maryland Eb 455 University Of Maryland Extension

Dave Rasmussen Author At Ion Solar

Green Energy Geeks Your Solar Renewable Energy Companions

Utah S Rooftop Solar Market On The Skids With Net Metering Change Pv Magazine Usa

Release Rocky Mountain Power Proposal Would End Solar In Utah Heal Utah

Does Solar Make Sense In Utah Freedom Forever

Resource Html Uri Comnat Com 2021 0950 Fin Eng Xhtml Com 2021 0950 Fin Eng 02002 Jpg

What Incentives Exist For Energy Efficient Home Upgrades In The U S Mansion Global

Utah S Rooftop Solar Market On The Skids With Net Metering Change Pv Magazine Usa